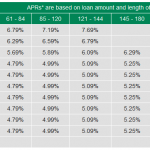

Among the many concerns for users of payday loans are the excessive fees and rates of interests often associated with these loans. While many people are forced to turn to these loans when a financial emergency arises, there is a lot of uneasiness due to the costs associated with borrowing this money.

Payday loan recipients also lament the fact that while interests they earn on investments like savings accounts and loans are taxable by the IRS, the interest accrued against them when accepting a payday loan is not tax deductible.

Many individuals make the mistake of thinking the totality of the interest associated with there payday loan can be written off on taxes. This makes the entire payday loan process more appealing to them. However, unlike the interest on home and student loans, the interest on payday loans is never deductible for individual tax returns.

The Business Payday Loan Exception

The one exception to the rule of no tax deductions on interest paid on payday loans is when the loan was taken exclusively to cover business expenses. However, it is important to understand proof must be provided that payday loan funds were used to cover costs associated with a legitimate business endeavor.

Most businesses would be better advised to seek funding from banks and credit unions with which they have already established a working relationship. However, the payday business loan alternative is available to those business owners without access to capital from other sources.

However, it is important to remember the fees and interest for payday loans are still higher than other options even when used for business purposes. It is also a pain to prove a payday loan was used for business purposes if the IRS decides to make a query.

Tax Reform Act

The Tax Reform Act was introduced into law in 1996 and stipulates that no type of personal interest payment can be deductible for income tax purposes. Before the act was introduced, it was not uncommon for individuals to deduct interest paid on personal loans from their tax responsibility.

The interest for payday loans, bad credit loans, credit cards, and auto loans all fall under this category. The Tax Reform Act was introduced by the Treasury Department to discourage irresponsible consumer spending. Another reason for the Tax Reform Act was the revenue hit taken by the federal government because of the tax deductions.

Payday Loan Alternatives

There are a number of alternatives to payday loans for individuals in need of cash. It is suggested that these options are explored before settling for the higher interest that will be paid for the payday loan.

A credit card cash advance can possibly provide a better option than payday loans to people in need of emergency funds.

A cash advance on a credit card can be the source of excessive interest if the money is not paid back in a certain amount of time. However, if the money advanced is paid back before the amount due date for the credit card, it is possible to repay this short term advance without any interest at all.

A second option to payday loans is an unsecured personal loan. There is no need for collateral for these loans and the interest rates are much better than with the payday loan. These loans are delivered by credit unions, banks, and online lenders. The interest rates are fixed and the loan is repaid in monthly installments.

Another option to payday loans is to seek a cash advance from your employer. Some jobs will provide an employee with a paycheck cash advances. The individual who works for a large company will need to talk to human resources to discuss this option. If the employer is a smaller company, the conversation can take place with the owner. Loans from employers usually take place at low or no cost.

Tax Deductions For Other Loan Interests

The interest on payday loans is not the only interest that is not tax deductible. One example of this is the interest paid on a car loan.

The interest paid for a car used for personal reasons is not tax deductible. However, you can deduct from taxes the cost of interest for a vehicle used for business purposes. If a car is used for both purposes, the borrower must calculate the percentage of use is for business.

The same restrictions are placed on interests for credit cards as payday loans and auto loans. Only credit card interest used for business purposes is tax deductible.

Interests payments that are tax deductible include:

- Home loan interest.

- Student loan interest

- interest paid on borrowed money to facilitate property investment

- Interest for business expenses

The Bottom Line

There are times when a payday loan can be a viable alternative for an individual or business who find themselves in need of an emergency cash infusion. However, it is necessary to understand all the fees and interests you are required to pay on these loans. It is also important to note the interest paid on payday loans is not tax deductible. It may be a good idea to consider payday loans only after you have exhausted all other possible alternatives check more info at LoanTruth.