Get Online Loans and Lending Advice.

Loan questions? Turn to the experts at LoanTruth for online loan reviews, loan advice, expert lending insights, money tools and more.

Easily compare loans and options to find the online loans that work with your credit.

Online Loans

The use and availability of online loans have steadily increased in recent years. However, there is still a considerable amount of confusion as to what online loans are and what they are not. The following will help to clear some of the confusion.

Online Loans Explained

Explained simply, an online loan involves borrowing money from lenders who allow you to complete the process completely online. The process for completing these loans are a little different from one lender to the next but many of the practices are common across the industry.

The Online Loan Process

The first step in the online loan process is to fill out an application on the website of the lender. Your creditworthiness will sometimes be checked by the lender in a matter of minutes. Based on your credit history, the lender will decide whether or not you are approved for a loan and the loan amount they are willing to provide to you.

Online Loan Safety

The short answer is sometimes. The standards for creditworthiness and other factors are often higher with traditional lenders. Online lenders often present less stringent approval standards.

This may sound like a good thing to individuals in need of money but some companies offering ‘bad credit loans‘ are a little less than trustworthy. In fact, some of these companies structure loans in a manner that it benefits them when a borrower is unable to make a payment. The missed payments will result in additional fees and interest and some of these companies depend on the extra revenue generated by this circumstance for their survival.

The credit standards upheld by traditional lenders help to prevent people from receiving loans they cannot afford. If your credit is less than desirable and you need a loan, consider a company that takes into account other aspects of your financial health before giving you a loan. Also, review companies for a history of predatory practices before doing business with them.

The Difference With Online Loans

Most people who choose online loans over those offered by traditional brick and mortar lenders cite convenience as the main factor. There is no reason for the borrower to leave their home throughout the entire process. The loan application is completed online and the borrowed funds are deposited directly into the borrower’s bank account.

The process of obtaining funds through an online loan is faster than with traditional loans. Approval decisions take place in minutes versus the days or weeks often required with traditional lenders. Money borrowed from online lenders can be deposited into the borrower’s bank account in no more than one business day.

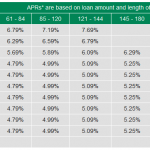

You may also find a lower interest rate for a loan when you choose to do business with an online lender. This is because online lenders do not have the cost of operations faced by traditional lenders and some of them are willing to pass these savings on to their customers.

Online Loan Types

The typical online loan falls under one of four categories:

Payday Loans

Payday loans are loans with extremely short terms and even higher interest rates. Two weeks is a typical term for a payday loan and the annual interest rate can be 300 percent. The average amount borrowed through payday loans is $350 and the principle and interest are expected to be paid in a single lump sum at the end of the loan’s term. Many borrowers find this one-time payment difficult to make.

When you are unable to repay a payday or signature loan, lenders will often times permit a ‘rollover.’ What this means is that you are allowed to pay only the interest accrued on the loan over the two week period. This amount is usually around 20 percent of the loan principal. The lender will then reset the loan term and reset the interest rate.

It is important to note that rollovers on loans are illegal in many states. Also, some states do not allow payday loans to be offered to their residents. This means that online payday loan providers cannot do business with customers in these states.

Title Loans

Title loans share similar traits with payday loans. The terms are short and the interest rates are high. These loans can also trap a borrower into a dangerous cycle of debt. The difference is a title loan is secured with an asset like a car, motorcycle, or truck. If you do not repay a title loan, you can lose the vehicle you used to secure the loan.

Higher principals are common with title loans versus payday loans since a high-value asset is used for security. Title loans are often for $2,000 or more with a term of one month. Lump sum payments are sometimes required. The average interest rate is 25 percent and rollovers can occur when the borrower cannot repay.

Title loans are also banned in some states.

Peer to Peer Loans

A peer to peer loan is originated from individuals versus financial institutions. Many P2P loans are facilitated by online websites. These websites provide a platform for borrowers and lenders to connect.

Installment Loans

Personal installment loans are generally considered to be the safest online loan option. However, caution should still be exercised when dealing with these loans. There are installment loan providers who do not perform adequate credit checks that will guarantee your ability to repay.

Installment loans differ from payday and title loans in that repayment is on a monthly basis. The loan terms are called installment which provides the loan type with its name. These monthly payments are often easier for borrowers to make and are less likely to result in an additional financial burden.

Fast Money Online Loans For No Credit/Bad Credit

Online loans are a quick and convenient way to find money when a financial emergency occurs. However, all online lenders are not equal. When considering an online loan offering, conduct enough research to know you are dealing with a lender providing competitive terms and interest rates.