Online Loan Statistics

A Look Into Online Loan Statistics For 2019

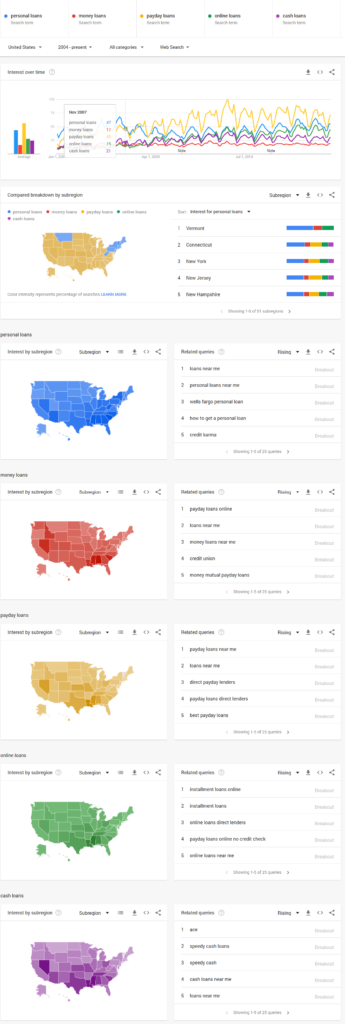

Online loans are not anything new. They’ve been around since the dawn of time to help people afford things that they simply don’t have the cash on hand to purchase. While the number of different providers continues to increase, the most popular arena is online through search engines. As people can receive quicker application response times and funding times with online lenders, more and more individuals are choosing these online lenders as their loan provider.

Personal loans are just one of the many types of online loans that are available for consumers. In 2018, the number of personal loans continued its increase to a whopping 19.5 million dollars. In 2019, this number is expected to rise even more. The popularity of this type of loan is that rates are typically lower than traditional credit cards, which makes personal loans great for costlier purchases. Personal loans also typically don’t require collateral to be given in exchange for the loan.

When looking at personal loans from the standpoint of what’s owed, you may just be shocked. Back in 2012, there were 55.7 billion dollars owed on personal installment loans. In mid-2018, this number more than doubled to 125.4 billion dollars. This number is expected to increase more throughout 2019. Many individuals are starting to use personal loans to pay for business startups as they’re a much quicker and easier way to get startup funds. No longer do entrepreneurs have to pitch their idea to capital ventures and hope for the best. With a few clicks of the mouse, they can get the funding they need in as little as a day.

We all love our vehicles, especially when they’re sporting the latest design. However, all vehicles come with that annoying little thing called a price tag. For most citizens, paying for a car with cash is just not doable. They typically have to apply for auto financing to fund their purchase. The loan industry has been racking up the debt for want to be auto owners. In 2017, there was 568.6 billion dollars owed on auto loans in the United States. This number continues to rise into 2019 and is expected to continue well into the future. This is due to the fact that car prices continue to rise as car manufacturers are innovating more and more desirable features.

Business loans are a trusted method to fund startups as well as seasoned businesses. In 2017, the average business loan was 663,000 dollars according to the Federal Reserve. The Small Business Administration (SBA) has noted an ongoing decrease in the number of small business loan applicants. This decrease has continued through 2018 and 2019. This downward trend is expected to continue due to the fact that many small business owners are opting for alternative lending platforms, such as online lenders and peer-to-peer marketplaces. This funding is typically easier to get with less strict requirements. Many of the applicants that are applying for traditional business funding are those larger businesses who have trust in the larger banks.

We can’t have a discussion about online loan statistics without bringing up payday loans. We’ve all been warned about their high-interest rates, but many still utilize them to make ends meet. In fact, about 12 million Americans will utilize a payday loan this year. It’s estimated that 7 out of 10 of those borrowers will use the payday loan funds to cover their basic expenses like food and rent. This type of loan can be helpful when utilized in a short-term fashion, however, they can get dangerous if you’re unable to meet your financial obligation.

Another sector of the online loan market that we can’t help but touch on is student loans. These loans may make you cringe if you have them. Statistics show that there are 45 million borrowers who have student debt. Among those 45 million borrowers is 1.56 trillion dollars in student debt. Yes, that’s a trillion! This more than doubles the total credit card debt held by U.S. consumers. With both private and federal debt, graduates are finding it harder than ever to get a solid financial footing in today’s society.

Student loans make up such a large sector of the current debt in our country. In fact, one out of every four citizens has student loan debt. Let that statistic sink in for a minute. It’s very likely that you or someone you know has student loan debt. Most end up paying close to 400 per month to meet their financial student loan obligations. In many locations, that’s close to a rent or mortgage payment for a house. A look at the recent trends between the most popular types of loans will reveal that student loans are taking a running lead over credit card and auto loan debt. This is projected to continue through 2019.

The fastest growing consumer debt, student loans, are creating a real crisis for our country. While the push to get more education is necessary to meet the strict application requirements of many businesses today, it comes at a hefty cost. The average student in 2018 graduated with an average debt of 37,172 dollars. This is a lot of debt to start out a financial career for many. Most will have their parents co-sign or help to pay for the loan.

Politicians across the board are becoming more and more concerned with the student loan debt crisis. In fact, presidential candidate Senator Elizabeth Warren proposed canceling out the first 50,000 dollars of student loan debt for over 40 million Americans. She states that people just can’t afford to pay back their student loans and more are defaulting than ever before. The Department of Education reported that out of the 1.3 million people who applied for an income-based repayment plan, only one-quarter of them earned over 100,000 dollars per year. With student loan payments close to 400 dollars per month, people’s incomes aren’t supporting their student loan obligations.