Title Loans

How much cash can I get?

Auto Title Loans

Auto Title Loans

Facing an unexpected emergency? It can happen to anyone, and unplanned problems can create financial challenges. It may be a medical bill or some other surprise expense. In many of these situations, a title loan may help you cover the expense. However, you need to understand what type of financial instrument this is.

What is a Title Loan?

A title loan is a secured loan rather than an unsecured loan like a credit card. The lender will put a lien on your property, in most cases this means your car. The car secures the loan. When you pay off the loan, the lender removes the lien and gives you back the title. If you are unable to repay the loan in full, the lender may repossess your car and sell it to recover the remaining amount of the loan

A title loan is a secured loan rather than an unsecured loan like a credit card. The lender will put a lien on your property, in most cases this means your car. The car secures the loan. When you pay off the loan, the lender removes the lien and gives you back the title. If you are unable to repay the loan in full, the lender may repossess your car and sell it to recover the remaining amount of the loan

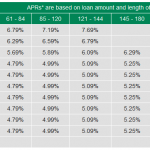

In many instances, title loans have short maturities, although they can have higher interest rates versus other types of loans. In general, a lender may not require perfect credit scores. Rather, they consider the value of your property that you offer as collateral to decide whether to approve the loan.

How Do I Obtain a Title Loan?

You will have some requirements to meet of you want to obtain a title loan. The first step is to ensure that you are working with a reputable financial company. Ask for a copy of their terms and agreements. Then read every part of it to ensure that you understand all the risks prior to signing the loan agreement.

The quickest method to finding a title loan is to start with an online search. You can easily narrow the options by eliminating companies that don’t have a branch near where you live. At the same time, consider those that offer lower rates. You want a local financial institution where you can get title loan.

The Benefit of a Title Loan

One clear benefit to an auto equity title loan is that the cash is available to you immediately. Many financial institutions can process your loan application within a short period. The process for a title loan is much more streamlined than other types of loans. Once the property is valued, the lender balances that value against how much you want to borrow. If you have property, you can apply for a title loan. The lender may not even check your credit history, which means that a bad credit score may not deter the lender. Other benefits depend upon the lender and the types of packages they offer. For instance, a title loan on a car can let you still drive the car after giving the lender the title and a spare set of keys.

When Would I Need a Title Loan?

If you need funds for an emergency and you have assets that can act as collateral, a title loan may work for you. The key is to use a title loan for emergencies. If you simply want extra spending money in your wallet or purchase something non-essential, a different type of loan would be more appropriate. You may also use a title loan if you don’t want to sell that asset to raise money.

What is the Application Process?

Each company has its own application process. In general, the process is more streamlined than applying for an unsecured loan. This is what you can expect:

1. Supply the vehicle title(pink slip) to the property

2. Fill out an application for a car registration loan

3. The company will appraise the property to place a value on it

4. Once they approve the loan, you will receive the cash. The lender keeps the title until payoff

5. You receive the title back when you payoff the loan or sell to a bank that offers title loan buyouts

How Does a Title Loan Work?

While you may have valuable property, typically a lender will accept certain types as collateral. This may be your car, home or savings. Most financial institutions will accept a vehicle title for collateral.

Many borrowers worry that they will not get their assets back. While that is a risk if you fail to make payments, you should have no problems getting title back when you repay the loan as per the agreements. If there is any chance that you might miss payments, don’t use an asset that you don’t want to lose.

How Much Can I Borrow?

In general, the national average in the U.S. is $150 for a single asset loan. This amount may be greater with property that has more value for a collateral-based loan.

How Do I Repay a Title Loan?

Each financial institution has its own payment methods. However, most accept a wide array of payment options. It may depend on your area. It will also depend on the company. Always double check their repayment policies. These can vary between lenders. You will find this information in the terms and agreements of the loan. Most institutions accept credit cards, debit cards, cash and online payments.

When is the Loan Due?

The due date will vary from lender to lender and the agreement. In general, payments start once you receive the funds. Check with the lender to determine your repayment schedule. Make sure to remain current at all times on the loan. Find out the amount of the payments and the due date each month.

What About Early Payment Fees?

The repayment plans will vary from lender to lender. Some institutions allow early repayments without extra fees. However, some do not. In general, early repayment fees usually are one to two months of interest. You may face additional charges if you want to repay the loan very early.

How Long Does Approval Take?

The approval process will vary between financial institutions and the type of collateral you offer. You can have the results that day, or it may take several days.

What About a Credit Check?

Title loans will be based upon the value of the property you offer as collateral rather than a credit score. Some companies may still inquire. Typically, it will not have an impact on whether the company approves the loan or not.

Is Collateral Required?

Yes, that is exactly what a car title loan is. Your car works as the collateral. The title will need to be in your name for the company to accept it. If your car has co-owners, the other person may need to be present when applying for the title loan or a title loan buyout.

What is “Get Cash, Keep Your Vehicle?”

This phrase means that you can keep and drive your car when you use the title as collateral for a loan. It would be very difficult to actually have the lender hold the car. You need it to get to work.

Where Do I Get the Title for a Title Loan?

The answer will depend on which state you live in. The regulations can vary significantly to obtain a title. It may also depend upon the type of asset you want to get the title for. Typically, you may secure title duplicates online, in person or by mail.

What if I Have Bad Credit?

You can still take out a title loan if your credit history is poor. In fact, title loans are a viable method to getting cash when you have bad credit. The approval process is based on the property rather than your payment history.

Can I Take Out a Title Loan After Bankruptcy?

Talk to the lender. You may have some limited choices; however, you can still take out a title loan after a bankruptcy declaration. Your financial institution will advise you of your options.

How Do I Get Back the Title?

Once your loan has been completely repaid on time, you should get back the title. Check with the lender about the process and make sure you understand the arrangement.

What Can I Use the Money For?

You can use the cash from a auto title loan for many types of financial necessities. In an emergency, this is a fast method for securing cash. You will not need to process multiple documents that are typically necessary for unsecured loans. Even better, you still have use of your property during the repayment period.

While a title loan can be a good option, you should take time to determine how you repay it prior to putting an asset at risk. Obviously, you don’t want to default. It’s still better to be prepared rather than having your car repossessed. Have a plan in place before getting a title loan. It has happened that people have lost the property because they fell behind in payments or failed to repay outright. Consider every factor that could impact your ability to repay the loan. Work with the lender to calculate to amount owed, know the repayment schedule thoroughly and understand all the terms and agreements.

Final Thoughts

Lastly, take some time to consider if you really need the money. Explore your various options and determine if you can afford the interest and fees. In addition, ensure that the company is reputable. Some may try to rip you off. Research the lender and ask questions when necessary. Your financial security depends on making good decisions today.