Refinance Student Loans

Get Accurate Refinancing Rates in just 2 Minutes

Federal student loan consolidation (or refinancing) combines multiple federal student loans into one loan. This allows you allows you to make one payment a month instead of multiple payments each month for many loans. When you refinance your student loans you have the option to combine your private and federal student loans into a new loan. This loan often has a lower interest rate than your previous loans.

Federal student loan consolidation (or refinancing) combines multiple federal student loans into one loan. This allows you allows you to make one payment a month instead of multiple payments each month for many loans. When you refinance your student loans you have the option to combine your private and federal student loans into a new loan. This loan often has a lower interest rate than your previous loans.

It’s important to explain that the student loans you obtained via a private lender can’t be consolidated. What you can do is to ask for a low interest rate or an adjusted repayment terms on the number of loans you have. The two options can save you thousands in interest charges over the life of your student loans.

Refinancing your student loans may be a more attractive option since you combine all your loans into one monthly payment. However, you will give up a lot of benefits of having multiple federal loans.

Refinancing your student loans may be a more attractive option since you combine all your loans into one monthly payment. However, you will give up a lot of benefits of having multiple federal loans.

For example, federal loans give you access to income-driven repayment programs. If you can’t make the full payment each month on your student loan(s), then you can pay an amount that works with your current income. Another disadvantage of refinancing is that you no longer qualify for loan forgiveness.

Loan forgiveness is a federal government program that cancels, or discharges, some student loans. This means you aren’t responsible for paying the balance of the student loans. Most people in the public service sector such as police officers obtain student loan forgiveness after 10, 20 or 25 years of paying their loans.

Why Refinance Student Loans?

Refinancing your student loans can lower your interest rate. This saves you thousands of dollars and allows you to pay your student loans off faster. It also provides peace of mind. After you refinance, you have a lower monthly payment. You’ve locked in a fixed interest rate. In addition, you have removed your cosigner from your private student loan.

When Should You Refinance Your Student Loans?

It’s always important to weigh your options carefully before deciding whether refinancing is right for you. Once you decide to refinance student loans, you want to do so after graduation. Why is this the time to refinance? You’re typically employed and you’ve established strong credit.

A strong credit history is important. It’s what you need to get a good, lower interest rate. A strong credit score shows lenders that you pay your bills on time and will repay you student loan debt.

You may not qualify for refinancing immediately after graduation. Sometimes lenders don’t consider you creditworthy. In this situation, you’ll need a cosigner. If you don’t want a cosigner, you’ll want to try later. Work on improving your finances. This includes paying down your credit card debts and other bills.

You don’t always have to go through the process of student loan refinancing to find out if you qualify. There are websites that allows you to check to find out if you pre-qualify for refinancing and the type of interest rate you may receive. It usually takes about two minutes.

Some student loan borrowers decide to refinance once they qualify for a lower interest rate instead of applying direct after graduation. This may be the case for you. However, some student loan borrowers choose to refinance loans with variable rates into a fixed-rate student loan. This has a higher interest rate. However, they are able to avoid a potential increase in their interest rates and monthly payments.

Which Type of Interest Rate is Needed: Fixed or Variable?

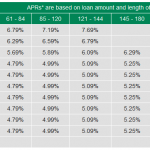

You can obtain a fixed loan where the interest rate doesn’t change for the life of the loan. Your other option is a variable interest rate loan. This means your interest rate may increase or decrease. Your options often comes down to your tolerance for risk.

For example, your variable interest rate student loan may start off with a lower rate. However, you take the risk of the interest rate increasing or decreasing from time to time. This means you won’t really know what your monthly payment will be because of the jumpy interest rate.

On the other hand, refinancing into a fixed-rate loan means the opposite. Your interest rate starts higher. The good thing is that the interest rate is locked in for the life of your student loan. This will help you know what you’ll pay each month.

Does Refinancing Student Loans Cost Money?

No. When you go through a third party company, lenders usually don’t charge loan application fees, prepayment penalties or origination fees.

What You Need to Know about Qualifying for Student Loan Refinancing

What You Need to Know about Qualifying for Student Loan Refinancing

Whether you qualify to refinance your student loans depend on many factors. These factors include your earnings history, credit history, credit report and the size of your loan. Lenders also consider the school attended or graduated.

Most student borrowers believe the most common reason why they qualify for a refinancing of their student loans is their credit scores. That’s not true. The most common reason why student loan borrowers don’t qualify for refinancing is their excessive debt-to-income ratio. This is called the DTI. DTI means that you have more monthly bills than you have income to pay those bills. Thus, your credit score may be high. However, if you have a terrible DTI, you may not qualify for refinancing.

You have two options if you have an excessive DTI. The first option is to work on payment your debts so that you have more income than debts. Once you have a lower DTI, apply for refinancing. Another option involves getting help from someone else. This means you may want to seek a cosigner for your refinancing if you have an excessive DTI.

Lenders allow co-signers to remain on your refinanced student loan for a specific amount of time. For example, a lender may offer a cosigner release after you make a minimum number of payments every month. These payments must be on-time payments. Once your co-signer is released from your refinanced student loan, you’re fully responsible for making all payments and not defaulting.This can be a good option if you know you’ll have the ability to repay your refinanced student loan in a timely fashion.

Is it Time to Refinance Your Student Loans?

Now that the only things certain in life are death, taxes and student loans, it’s important to know about refinancing. Most third party services require you to fill out a form to select from the large number of lenders. You get to check your rates without hurting your credit score.

You can also check to see if you pre-qualify without going through the entire process. This means that you know where you stand prior to committing to the refinancing student loan process. Typically, the third step in the process is to provide the details of your student loans. After a couple steps, you’ll receive a final offer.

Refinancing is the process of putting your multiple loans in one monthly payment. It can take the hassle of trying to make several student loan payments during different times of the month. You also have the option of consolidating your student loans. Both refinancing and consolidation has their advantages and disadvantages. The most important thing to do is to understand both options and choose the one for your financial situation.