Installment Loan Statistics

Updated 11-11-2022

Installment Loan Statistics 2022-2023

- Interest rates on installment loans dropped 4% in 2021-2022(relative to Credit cards rates)

- Avg. income of installment loan borrower is $32k

- 32 US states capped installment loan interest rates at 17-36%

- 20% of installment loans default on payments

- 2019 started with $403,0,000,000 of consumer debt (tracked by the Federal Reserve)

- ~68% of installment payday loan borrowers use the loan to pay monthly recurring bills like cells phones and rent

- In 2022 new automotive installment loan rates hit a 5.5% (up 1.5% from 2015)

- Default rates for installment loans increased 16% 2016-2023

- Americans pay $10,000,000,000 each year on interest and loan origination fees for installment loans.

Installment Loan Facts 2022-2023

Installment loans are a very popular way to finance everything from a college education to a new vehicle. These types of loans are considered those with fixed loan terms that have a set term length. The interest rate on this type of loan will vary depending on the individual, lender, and/or use of funds. Today, we’re going to take a look at some of the statistics that have been discovered about installment loans in 2019 that will give you some better insight into this financial lending sector.

Installment Loan Interest Rates Are Dropping An Average of Four Percent Compared To Credit Cards

Financial masterminds like the Federal Reserve have been tracking the trends in interest rates for a wide variety of credit options. These include credit cards, personal loans, mortgage loans, and auto loans. All the three latter are considered to fall in the general category of installment loans. In general, credit cards tend to have the highest interest rates. This is followed by personal loans, auto loans, and then mortgage loans with the lowest interest rate. Comparing personal loans to credit cards, the interest rate has dropped by four percent since 2018. This means personal loans are getting cheaper while credit cards are getting more expensive to use.

12 Million Americans Use Payday Loans Each Year

We’ve all seen the warnings issued by debt assistance organizations about payday loans. These types of loans tend to come with extremely high-interest rates and origination fees. Many borrowers for payday loans earn around the 30,000 dollar range. When they run into cashflow problems trying to cover their bills, they turn to payday loans. These types of loans don’t rely on credit history so many individuals can get approved with just income verification.

Installment Loan Rates Are Typically Capped Between 17 and 36 Percent

When you are looking for money to fund a large purchase, a low-interest installment loan is your best option. This is assuming you have good credit. However, if you don’t, realize that installment loan lenders typically have to follow state laws regarding maximum interest rates. In a survey taken of 32 states that implement a cap on the interest rate for an installment loan, their average cap rates ranged from 17 to 36 percent interest. It’s also important to note that this is very much state specific. In fact, five states don’t implement caps at all on installment loans.

20 Percent Of Payday Loan Sequences End In Default

The Bureau of Consumer Financial Protection did a study of the impact of payday loans on individual borrower behavior and financial outcomes. Part of looking at payday loans is understanding the loan sequences that can occur from a single loan. This type of sequence is when the borrower only pays interest and continues to owe on the payday loan for another loan term. This type of loan sequence has shown to end up in default 20 percent of the time.

Consumer Oustanding Credit Was 4030 Billion Dollars In January

The Federal Reserve diligently tracks the amount of consumer debt that is still outstanding each and every month of the year. For January 2019, the outstanding consumer credit was marked at 4030 billion dollars. This is up from 4012 billion dollars in December of 2018. That’s a total of 18 billion dollars of extra outstanding credit in one single month. This can be further broken down to show revolving debt at 1058 billion, which is going to be things like credit cards, lines of credit, and retail or store cards. Nonrevolving credit was at 2972 billion dollars which is comprised mainly of installment loans.

The Delinquency Rate On Consumer Loans Is 2.34 Percent

Commercial banks keep track of the amount of borrowers who default on their loans so that they can better assess their company’s risk in the future. In a recent economic research study by the Federal Reserve Bank Of St. Louis, it was determined that around 2.34 percent of installment loan borrowers default on their loans. This number is trending upwards since 2016 when default rates were at an all-time low around 2 percent.

The Average Interest Rate For A Four Year Auto Installment Loan Is 5.50 Percent

If you’re looking to finance a new vehicle, now may be a good time to lock in your rate before it gets higher. Auto installment loans were at an all-time low around 2015 with interest rates close to four percent. Since then, auto loan rates have slowly been climbing higher and higher. In November 2018, the average interest rate was 5.29 percent. In February 2019, the interest rate has jumped to 5.50 percent. The interest rates for auto loans are expected to continue to climb over the next few years.

69 Percent Of Payday Loan Users Use The Money To Pay For Recurring Expenses

In a recent study, it was revealed that an astounding 69 percent of all payday loan borrowers use the fund for their recurring bills. These are bills like rent, food, cable, phone, and credit card bills. This doesn’t include unexpected expenses like car repairs or medical visits that are supposedly the reason that this type of high-interest short term loan is offered to the public. This statistic shows that the majority of payday loan users are those who have a constant shortage of cash. They’re more likely to continue to take out payday loans in multiple loan sequences.

Americians Spend Over 10 Billion Dollars On Installment Loans Each Year

Taking a look at the actual costs of using online installment loans to fund your purchases can be eye-opening. It’s estimated that Americans actually pay over 10 billion dollars each year on interest and loan origination fees for installment type loans. These loan amounts range from as small as 100 dollars to tens of thousands of dollars. These loans are typically comprised of payday loans, auto loans, and personal loans.

There are many statistics that are discovered about installment loans each and every month. Many protection agencies use their own sources to get the data they need to recommend specific regulations to the federal and state governments. The above are just some of the major highlights when it comes to specifically assessing installment loans and personal signature loans from an analytical standpoint.

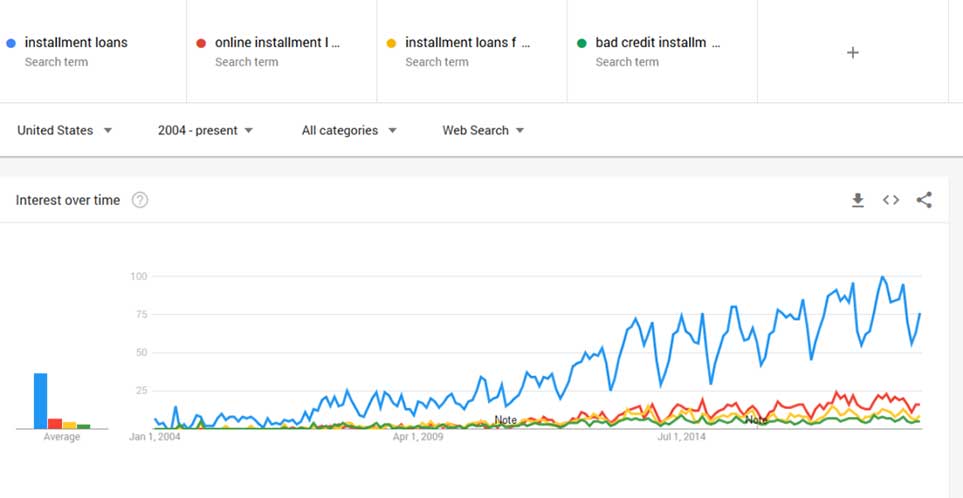

installment loans, online installment loans, installment loans for bad credit, bad credit installment loan google trends graph 2004-2018-2019-2020