No Credit Check Online Loans

What Is a No Credit Check Online Loan?

Would you like to apply for a loan but you are worried about it affecting your credit score? Are you confused by the loan terminology and wondering what it all means?

Could you benefit from a loan of up to $10,000 if it didn’t affect your credit score?

Read on to learn more about no credit check loans with LoanTruth.

With LoanTruth, you can do all the preliminary application work to find out if you qualify for a loan of up to $10,000 – without it affecting your credit score in any way.

How is this possible? It is possible because there are different kinds of credit inquiries and not all inquiries affect your credit score.

For example, you can check to see whether you might be eligible for a flexible personal loan of up to $10,000 right now and it won’t impact your credit score at all.

Here at LoanTruth, our goal is to protect your credit score and help you improve your credit going forward.

We have constructed a loan application process that allows us to do our due diligence before extending loans but protects your credit from the negative impact of a loan application. What you need to know is simple: when you apply for a loan with LoanTruth, we protect your credit as if it were our own.

You can check your eligibility for a loan without any impact to your credit score.

Our fast and easy online application factors in a diverse data set, including but certainly not limited to your credit score, before determining your overall eligibility.

This method is called a “soft credit pull” and you can read more details about how it works below here. But what you need to know right now is that soft credit pulls do not affect your credits core because of how the credit reporting bureaus view them.

LoanTruth’s analytics extend beyond a simple credit score.

We understand that a number of factors can have an influence over each applicant’s potential eligibility to qualify for a loan. Perhaps your credit score is not stellar but there may be other elements that balance that out and help you qualify for the loan you need.

By factoring in other parameters besides just your credit score, we can get a bigger picture perspective of you as a loan candidate without harming your credit score.

This is why you can actually improve your credit with a LoanTruth loan.

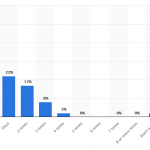

Many applicants don’t understand the full impact of a loan or line of credit on their credit report and credit score. Did you know that applying for a loan with LoanTruth can actually help you improve your credit score and begin to rebuild your credit report history?

Just like any other loan or line of credit, your LoanTruth payments will be reported to the credit bureaus, who will treat them just like any other loan payments in terms of computing your credit score. So when you pay your LoanTruth loan back on time and in full, your credit history improves and your credit score increases.

It really is that simple.

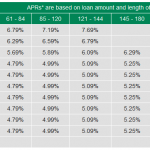

With LoanTruth, you can apply to receive a personal flexible loan of up to $10,000. You can also apply to receive a personal line of credit of up to $3,500. The amount you qualify for will depend in part on where you live and other factors as outlined here.

How to get started with your online loan application.

- The first step is to use our simple, secure online application to check your overall eligibility. This application uses the “soft credit pull” method we described earlier here so it does not impact your credit score.

- The second step is to take some time to consider your results, deciding if LoanTruth’s loan terms and amounts will meet your needs.

- The third step is to select from the options and agree to the terms. This starts the process of transferring your funds. It is a very fast process and often you can receive your loan funds the same day.

Still worried about how your LoanTruth application might affect your credit score? Perhaps this example will help.

Jessica knows her credit has had some problems in the past, which makes her concerned about applying for a loan even though she needs one. She finds out about LoanTruth and decides to take a chance and apply using LoanTruth’s online application process. To her surprise, she qualifies for the amount she needs!

Jessica agrees to the terms, completes and signs the loan agreement.

At this point, her agreement to LoanTruth’s loan terms and receipt of the money triggers a hard credit pull.

This does affect her credit, but Jessica isn’t worried because she understands that as long as she abides by the LoanTruth loan agreement terms and makes each loan repayment on time and in full, she is actually building a better future credit score.

LoanTruth Frequently Asked Questions

- What is a “no credit check loan?”

This loan type permits borrowers to apply for and receive short-term loans without the need to do a hard credit check which could affect the borrower’s credit.

Pros include being able to qualify without great credit and get the necessary funds quickly. Cons include steep fees and penalties.

- What is a soft credit pull?

This type of inquiry helps lenders evaluate a potential borrower’s eligibility without triggering impact to that borrower’s credit score.

- What is a hard credit pull?

This type of inquiry will be noted and recorded by the credit bureaus and may impact your credit score for 24 months.