Refinance Statistics

Refinance statistics 2019-2020, 2018-2017

- 77% of refinanced loans take on 5% or more in dollar value

- $14.8 billion in home equity was exchanged for cash in the form of refinanced loans

- #1 reason for financing is to consolidate debt (credit cards/small loans/auto loans)

- $104.8 billion of mortgages that was refinanced in Q2 2019

- Rates dropped overall for the year

- 2 year treasury notes currently yield higher than 10-year treasury notes

- Volume is expected to increase at least 7% in 2020

Before we get into talking about some of the most interesting statistics related to refinancing existing loans, you need to know what, exactly, refinancing is.

What Is Refinancing?

When you get help from a lender to purchase something, the good you buy has been financed.

Refinancing, on the other hand, refers to when people, organizations, or businesses go to independent financial service providers and ask them for a loan. This loan is just large enough to pay off the current debt account they’ve got open. The lender of this loan then engages the borrower in a deal that ultimately results in the consolidation of multiple debt accounts, the shortening or lengthening of the loan term, typically the reduction of interest rate, and other changes that provide an incentive for people, businesses and students that are in debt to refinance their loans.

One of the most common types of debt that gets refinanced is that of mortgages.

Mortgage Refinance Facts

Now, you’re more than ready to learn some interesting, thought-provoking statistics regarding refinancing, particularly the refinancing of mortgages.

1. Loan Amount Changes Of 5 Percent Or Better Are This Popular

In the United States, according to Freddie Mac, in the first two quarters of 2019, respectively, the percent of refinanced loans that ultimately took on 5 percent or more in dollar value was 77 and 61 percent for the first and second quarters of 2019.

This means that most consumers who choose to refinance are highly likely to ultimately be forking more money over to financiers that refinance borrowers’ existing loans.

2. Mortgages Aren’t Refinanced As Often As They Used To Be

In the second quarter of 2006, for reference, the total dollar value of mortgages that were refinanced was $104.8 billion. In 2018’s fourth quarter, according to Freddie Mac, as well, just $14.8 billion in terms of home equity was exchanged for cash in the form of refinanced loans.

This is a good sign for the current consumer home borrowing market because the first statistic above was just a year before the Great Recession. $14.8 billion is low, which looks good.

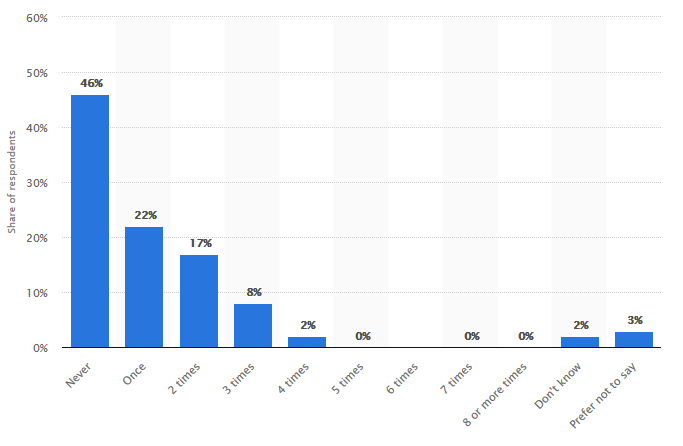

3. These Are The Leading Reasons For Refinancing Mortgages

One major reason why American homeowners want to make new, improved loans in exchange for their existing mortgages is to smash together multiple debt accounts, making keeping up with them a lot easier. Another reason is to pay off big-time expenses that are looming on the horizon.

Although you may want to refinance your home mortgage for another reason, it’s most likely that you will want to do so for one of these two reasons, if not both.

4. Mortgage Rates Are Super Low Right Now

Mortgages’ interest rates are just about the most important metric to look to when gauging how good a mortgage offer is. Two months ago, in June 2019, the average annual percentage rate – APR, which is short for annual percentage rate, is the effective interest rate for a loan, meaning it expresses how much you’ll actually pay in a year’s time with fees included in terms of a percentage interest rate – was just 4.09 percent on 30-year fixed-rate offers, says NerdWallet. This is great for borrowers, as well as for those who want to potentially refinance such mortgages on down the road.

5. This Is How Many Dollars’ Worth Of Domestic Mortgage Refinances Are Worth

For the second quarter of 2019, which ran from April 1, 2019, to June 30, 2019, more than $146 billion in domestic mortgages were refinanced in the United States. This is up nearly 50 percent from the previous quarter, in which just $97 billion in mortgages were given out to borrowers across the United States.

The less money is spent on refinancing mortgages in the industry as a whole, the more favorable terms you’re likely to get if you sign up to have your mortgage refinanced.

6. Mortgage Rates Could Be Super Low In Sept. 2019

Market factors such as the fact that the various types of United States Treasury Bonds are doing so horribly, as well as the fact that the two-year Treasury note currently has a higher yield as compared to its 10-year Treasury note counterpart, mean that mortgage rates could be very low next month.

7. Rates Are Going Lower Soon, Most Likely

Since it’s highly likely that mortgage rates are going to drop in the next few weeks or months, it will soon be the best time possible for homeowners to refinance their mortgages.

This is believed to be true because there was a refinance boom earlier this year that ended in April 2019. Since it hasn’t gone on for a while, it’s likely that the boom is going to start back up very soon.

Reasons to Refinance In 2019