Personal Loan Statistics

Personal Loan Statistics 2019-2020

- 31% of personal loans are to pay for cars and trucks

- $125 billion is owed to lenders in 2019 for personal loans

- From 1992-2019 the average value of a personal loan jumped 117%

- In 2019-2020 some 39% of personal loans originated online

- Q1 of 2019 there was 23% of personal loan balances growth in America

- As of 2020 proportion of personal debt is 77.8%t to GDP in the U.S

- Google banned personal loan apps from the Google Play Store in 2019

People take out loans to pay for all kinds of things. Personal loans are a type of installment loan that people can take on to pay for whatever they want. However, since they’re less structured than car notes, mortgages, and other types of loans that can only be used for specific purposes, borrowers end up unable to pay their personal loan debts back more often than with other types of loans. On the other hand, personal loans are great for emergencies or paying for things that don’t have existing specific-use loans available for them.

Whether you like personal loans, aren’t a fan of them, or simply want to learn more about them, here are six statistics that you might find interesting.

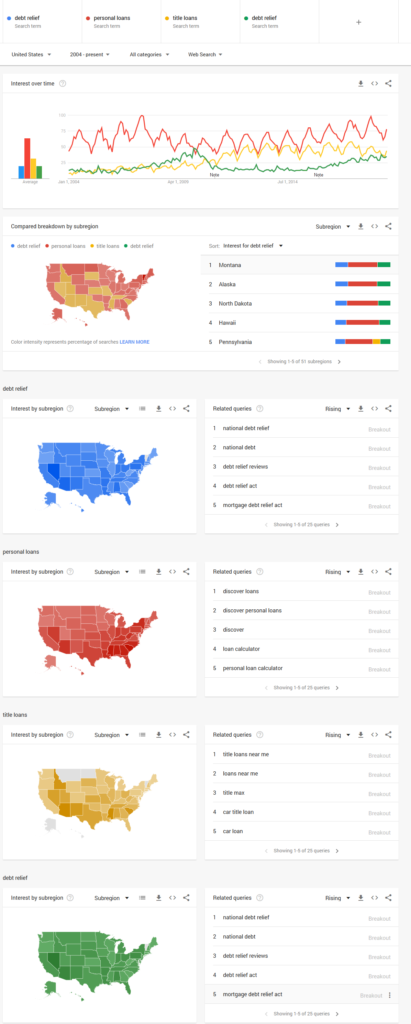

1. Personal loans have become significantly more popular in recent years

In the middle of 2019, statistics showed that Americans collectively owed just more than $125 billion to lenders to pay back personal loans. The current size of the personal loan market has more than doubled in less than a decade, as Americans owed just $55.7 billion to creditors in the name of personal loan debt in 2012.

One reason why personal loans have become more popular is that consumers are more frequently headed to small, non-traditional financial service providers like title loan providers and check-cashing businesses. These lenders are more likely to offer personal loans as a way to differentiate themselves from tried-and-true, well-established, traditional financial institutions like banks. As the financial services market becomes more segmented in coming years, personal loans will continue to rise in popularity.

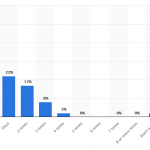

2. People usually take out personal loans to cover vehicular expenses or regular bills

Statistics show that 31 percent of personal loan borrowers take on such debt to pay for vehicles, which includes both the purchase of new vehicles and repairing ones that they already own. About one-quarter percent of people who have taken out personal loans have done so to pay for expenses that occur regularly, such as paying for utilities and rent.

Both of these personal loan uses will become more prevalent in coming years as the gap between low-income households and their wealthy counterparts widens.

3. The value of personal loans is becoming greater as years pass

Personal loans for small amounts of money have been available for some time. As competition between lenders willing to take on unsecured personal loans has increased, lenders have been forced to stick out from the crowd by offering personal loans of greater values.

In 1992, the median value of personal loans for households across the United States was about $7,800. By 2016, the median value of Americans’ personal loans had skyrocketed to a whopping $17,000. Expect this trend to continue in coming years as personal loans become more popular.

4. Personal loan debt will rise in relation to GDP

Gross domestic product is a financial metric usually used to compare performance between two or more economies or judge a single economy’s performance over the years. Also known as GDP, gross domestic product is calculated by estimating the total dollar value of goods and services that an economy pumps out over a given time period.

In 2018, the proportion of personal debt in the United States to GDP was 77.8 percent. That figure is slated to increase in coming years to as much as 92.7 percent by 2029. The reason for the increase in this proportion is not that the United States’ economy will shrink; rather, people will take on more debt because they will find it harder to pay for things over time.

5. Online lenders have played a major role in the personal loan industry’s growth

In 2010, says TransUnion, one of the three major credit bureaus in the United States, less than one percent of personal loans were fixed by online lenders. In 2018, some 36 percent of personal loans originated from online lenders. Expect this trend to continue as online lenders make it easier for Americans to take out loans.

6. The outstanding balance of personal loans continues to grow

In the first quarter of 2018, outstanding balances of personal loans rose about 20 percent in terms of year-on-year growth. This was one of the largest leaps of personal payday loans‘ outstanding balances in American history. This metric will keep growing at unprecedented rates as online personal loans lenders and small, nontraditional financiers open their doors to people seeking unsecured personal loans.