Take your time and read the contract before you sign anything. Don’t be afraid to ask questions until you understand the deal that you are entering into for the installment loan. If the terms do not feel right to you, continue shopping around until you find a loan that suits your needs and budgetary requirements. In most situations, you can prequalify for the loan and get an idea of the terms based on your credit and income. This opportunity will help you to make an informed decision and get the deal you need.

Personal Finance: The Pros and Cons of Installment Loans

What is an Installment Loan

There are certain situations where an individual needs to borrow money through a personal loan and then repay the funds through fixed monthly installments. Depending on the financial institution and the requirements of the loan, you may have a fixed payment amount that will stay the same throughout the entire payment period. Other loan opportunities may offer a variable interest rate, which can cause the amount of your monthly installment to change.

While you might not be familiar with the term “installment loan,” chances are you have already used this type of lending agreement in the past. Other common loans that are considered to be installment loans include auto loans, home loans, and other kinds of personal loans. Each monthly payment that you make is considered to be an installment, which is why these loans fall into this category.

The Pros: Why Installment Loans are Beneficial

One of the most significant advantages associated with an installment loan is that the payments are set and predictable. For most individuals, this makes budgeting for and repaying the loan a lot easier. Because the loan is due on the same day every month, it makes it harder to forget to make a payment, reducing the chances for missed payments that could impact your relationship with the lender.

Another benefit is that when you start looking into an installment loan, you will be able to see the total amount due, the monthly payment, the interest amount, and the prospective due date for the loan. Having all of this information will help you to decide if the installment loan is right for you based on your budget, pay schedule, and other personal factors. Avoid monthly payments that are too high, or you’ll risk falling behind if your paycheck is short or if you have an unexpected expense occur that takes priority.

The good news is that when you enter into an agreement for an installment loan, you will have all of the facts, including the date that the payments are complete. Make sure to ask additional questions, such as whether you can make extra payments or if you can pay the loan in full without risk of a pre-payment penalty. These options can help you to pay less interest over the life of the loan.

The Cons: Why Installment Loans Can Be Problematic

Not all installment loans are created equal – you have to read the fine print. When you compare an installment loan to an open line of credit or using a credit card, the most noticeable difference is that the loan amount is structured. If you need to borrow more money, you would need to get another loan. You have to make sure that you get an installment loan for the exact amount of money you need upfront.

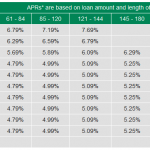

Your credit score will determine the amount of money that you can borrow and the terms of the agreement. For example, if you have fair or poor credit, you will have to pay a higher interest rate than someone with good or excellent credit. Your monthly payments will be higher, and the terms might be more strict in other ways. Take into consideration your credit score before you apply for an installment loan.

The solution is to work on making improvements to your credit score before you apply for an auto, home, or personal installment loan. Be aware of the limitations to the loan, such as application fees, credit check fees, and other costs associated with obtaining the loan. Be sure to ask about late fees, annual fees, and pre-payment penalties that could impact your ability to pay the loan off on your terms.

The More You Know

The three most common types of installment loans include auto, home, and personal loans. While they are all very similar, there are still distinct differences that you need to know about before getting a loan. The terms can vary between lenders based on what it is that you are trying to finance. For example, a brand new vehicle might have a higher interest rate and longer monthly payment schedules than a used car.

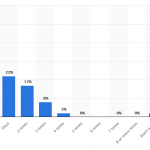

- AUTO LOANS – When applying for an installment loan, make sure you know what you are getting into before you sign an agreement. Auto loans can range anywhere between 12 to 96 months to help borrowers get a payment schedule that they can afford. An extended payment plan also means you’ll pay more interest throughout the life of the loan.

- HOME LOANS – Mortgages can range from 15-30 year terms with set monthly payments. While most home loans feature fixed interest rates, many offer variable interest rates that can result in higher than expected payments down the line. Be sure to discuss the possible changes in your monthly payment if you choose a variable interest rate installment loan to purchase a home.

- PERSONAL LOANS – Most personal loans are very similar to auto and home loans. They are commonly used to pay off debt, such as high-interest rate credit cards, loans, or even medical bills. However, because a personal loan does not require collateral to secure the debt, they will typically come with a higher interest rate than other types of secured loans. Terms can range between 12 to 96 months, similar to an auto loan, depending on the lender.

Is an Installment Loan Right for You?