Installment Loans

Installment Loans

What is an Installment Loan?

When you do not have the cash or liquid assets on hand to make the purchase that you want or pay the bills that you need to pay, an installment loan is an option you can consider. What an installment loan does is offer you a lump sum amount that you can pay off over time in convenient monthly payments. These payments are typically withdrawn from your checking or savings account automatically each month, which simply adds to the convenience. With that being said, payments can also be made in person, online, or over the phone through an automatic system, depending on your needs.

Installment loans are often what is called unsecured loans, meaning there is no required collateral associated with the personal loan. The larger a loan is, however, the more likely some form of collateral might be requested by the lender. Your credit score is occasionally taken into account when determining whether you qualify for a loan, but more often, the recipient of the loan must prove job stability and meet the minimum salary to debt ratio, making them an excellent option for individuals with subpar credit.

Finally, installment loans are unique because they can typically be paid off early without any penalty. Most loans, on the other hand, come with steep fines because the lender wants to make money off of the interest rate; profits for lenders tend to be diminished when borrowers pay off loans early. Furthermore, making regular payments or paying off an installment loan can help keep your credit score regulated and even raise it over time. Having a strong payment history can also have a positive impact on lending in the future. Should you find yourself having trouble making payments for whatever reason is definitely something to bring up with your lender, so you can make arrangements to ensure the loan can still be paid off at a longer term with limited negative impact on your credit.

Finally, installment loans are unique because they can typically be paid off early without any penalty. Most loans, on the other hand, come with steep fines because the lender wants to make money off of the interest rate; profits for lenders tend to be diminished when borrowers pay off loans early. Furthermore, making regular payments or paying off an installment loan can help keep your credit score regulated and even raise it over time. Having a strong payment history can also have a positive impact on lending in the future. Should you find yourself having trouble making payments for whatever reason is definitely something to bring up with your lender, so you can make arrangements to ensure the loan can still be paid off at a longer term with limited negative impact on your credit.

When is it Time to Apply for an Installment Loan?

The purpose of an installment loan is to get an advance on cash that you will be able to pay off over time. These loans are a great alternative to waiting for an extended period of time to be able to afford larger expenses. Installment loans that are used to consolidate debt are typically used because they offer borrowers a lower interest rate, which means that you can get the money you need and not have to pay an arm and a leg in interest over time. Therefore, the sooner you apply for one, the sooner you can get your debt together in one monthly payment. Because these loans tend to be used for larger expenses, it is definitely important to stay aware of the long-term responsibility of paying off the loan within the terms expressed at the time of signing. Like any financial commitment, it is better not to rush into it without giving it appropriate thought.

What Factors Should Be Kept in Mind when Considering an Installment Loan

Like any loan, there certain aspects you should keep in mind prior to taking out one of these long-term commitments.

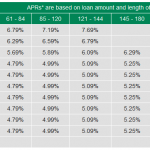

- The Interest Rate

Interest rates on installment loans tend to be fixed, meaning they will not fluctuate with the market. The lower the interest rate, the less you will have to pay on top of the principle, or the amount you have taken out, over time. The interest rate is typically determined based on your credit score, but it can also vary depending on the amount of your loan as well as any collateral you might be required to provide. - The Loan Amount

The amount you are qualified for is also often contingent upon your credit score. A good rule to keep in mind is to only borrow what you need to borrow and not necessarily as much as you are approved for. Borrowing more than you had intended can lead to financial consequences that are less than pleasant, especially if you find yourself unable to make the monthly payments. Furthermore, the amount of your installment loan can influence the interest rate, so it is a good idea to maintain a sense of control over your finances by taking out exactly what you need and nothing more. - Loan Terms

While there are some things in life where you might not care about the fine print, a loan is most certainly not one of those things. The terms and conditions of an installment loan are pinnacle; they are one of the most important factors to consider prior to taking out an advance. The terms of an installment loan can range anywhere from six to sixty months, with the longer loans typically resulting in lower monthly payments. With that being said, sometimes shorter terms are better because you pay it off quicker and give life less time to throw financial curve balls your way. In either case, most installment loans can be paid off early with little to no financial penalty. - Potential Risks

As with any loan, there are some risks that need to be kept in mind. Installment loans are just that – loans that are dispersed with the understanding that the borrower will make monthly payments on time until the loan has been paid off completely. While some lenders, such as the Loan Truth, encourage borrowers to pay off these loans early, individuals who fail to make payments on time or at all will be penalized. Unpaid loans are often sent to collections, and credit scores can suffer damaging consequences as a result of delinquent or missing payments. Therefore, be sure to put substantial thought into the interest rate, amount, and terms of an installment loan prior to borrowing.

What Are the Benefits of Taking out an Installment Loan as Opposed to Other Loans?

Installment loans are not like other forms of credit.

- Easy Approval Requirements

Because installment loans are typically unsecured, it is really simple to qualify for one. Even with below average credit, you can still be approved for an installment loan, albeit the interest rate might be a little higher. Otherwise, collateral is rarely needed, and a steady income is all that it takes to being one step closer to taking out the loan that you desire. - Clear Conditions

Some loans are written in such a way that no person lacking formal legal training would be able to understand the terms and conditions. That is one reason installment loans are a great option. Installment loans are designed to be as straightforward as possible. There are no hidden terms or fees, making them easy to understand and easy to decide on. Unlike other forms of lending, installment loans come with a fixed amount, interest rate, and lending terms, so there is never any guesswork, and you know exactly what you are signing up for. - Convenience

Some loans come with intense strings attached. Fortunately, installment loans are different from your average personal loan or bad credit loan. These loans are notable for being really easy to set up and maintain. Applications can be handled in person, online, or over the phone in a matter of minutes. Payments can be deducted from your bank account automatically, eliminating the need to remember to make that payment every month. Finally, if you ever find yourself with questions or concerns, representatives at Loan Truth are always available to speak with you and help you find the answers you need.

Why Choose Loan Truth for Your Next Installment Loan?

Now that you know what an installment loan is and you have spent some time going over whether this loan is the right option for you, it is time to pick a loan provider. In today’s day and age, you can find installment loans on any corner of a town or any number of websites on the internet, but installment loan providers are not all the same. When you are deciding on something as long-term and serious as an installment loan, you want to make sure you choose a loan provider who is reliable, communicative, friendly, and who has your borrowing interests in mind at all times.

Loan Truth has the experience necessary for understanding the ins and outs of installment loans. In fact, they have been providing installment loans and outstanding customer service for decades. There is a reason they have been able to stay in business and maintain a reputation for excellence all of this time: Loan Truth puts customers first at all times because they understand how important it is to establish and maintain financial stability.

Loan Truth is not your run-of-the-mill loan provider. There is a reason they have an exceptional reputation as an ethical lender who has unmatched loan processing times and loans with terms that are clear and reasonable. Put your financial well being first and go with Loan Truth to ensure you go into installment loans and their payments, rates and commitments with a business you trust.