Boat Loan Statistics

Boat Loan Statistics 2022-2021

- Average boat loan terms are 16-20 years

- Boat financing is usually 15 years for vessels $25k-$74k

- ~ 33,000 boats sold per year

- 240 months or 20+ years ( 21-35% range. )

- Recessions drive a 48% drop in marine lender originations

- Certain vessels qualify for tax benefits as a second home.

Boat Loan Facts 2022-2023

According to boats.com new and used boat purchasers can expect to receive boat loans for terms of 16-20 years and there is most often zero penalty for early or pre-payment. This guide explains average terms more.

The industry standard of the boat financing industry is a boat loan of 15 years for vessels 25k-74k. 20-year boat loan terms are also the most often package for boats valued at $75k and up. Most often a down payment for a new boat loan is 15-20%. Read more about this at Sterling Acceptance

Boat Financing Facts 2022-2021

Statista has compiled some boat loan statistics for the us and has some interesting points to consider. In the USA there are over 16 million boats and of those the greatest portion that were purchased with boat financing are boats with lengths of 36-45 feet. Yearly there are about 33,000 boats sold per year.

- From 2015-2019 the average household income of a family that owned a boat is just over $202,000

- More recreational boat loan stats can be found on this page at their website.

Repayment terms of 240 months or 20+ years can be found but usually require higher down payments in the 21% range. However, it is also dependent on the amount of boat you buy with a larger vessel being more apt to receive such terms.

Monthly payments on a boat loan when added to storage costs, maintenance and insurance fees should be no more than 42% of your monthly disposable income and banks check to make sure you are in this sweet spot when considering you for a low-rate boat loan.

Sverage Boat Loan Terms

In 2019 you can discover some online boat loan and financing lenders will offer terms of 12 years or 144 months on RV and boat loans in the USA with A+ rating such as My Financing USA

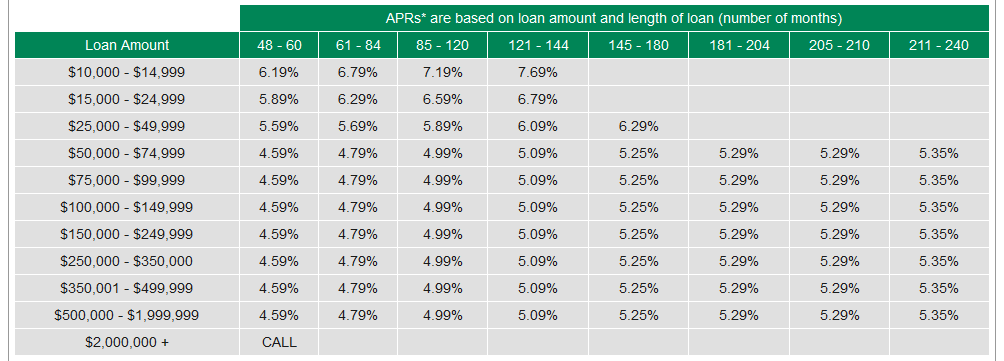

Boat Loan Rates 2021-2022

In 2021 the average rate for a boat loan is 4.59% – 6.19% with good to great credit scores. Bad credit boat loan rates tend to be a bit higher. These rates are all similar rather it be for a new boat, a used boat or a boat loan refinance loan. Learn more about boat loan rates at Essex Credit.

Boat Loan Interest Trends 2019-2020

As the fed has signaled a willingness to drop rates in 2021-2022 through 2019-2020 it could signal a recession cycle, in which sales on luxury items like boats and sail boats settle quickly. To curb this drop in buying power rates on boat loans may drop before homes or cars.

Marine Loan Maximum Terms From Lenders

Most boat financing firms offer limits on the amount of loan they will take on for a new or used boat. This tends to be at or near $100,000.00. However, you may be able to leverage a low-rate personal loan or a home equity line of credit you may be able to get more if you do not have poor credit.

Finding marine Lenders

You can search online for the lowest prates on boat loans or browse lenders in the marine space. Or you can check out the LoanTruth approved lenders below:

Boat loan interest may be Tax Deductible

If the boat you purchased has a galley, sleeping berth, and head it qualifies as a second home in tax codes and boat loan interest can be deducted on your federal tax return for 2018-2019 and 2019-2022. But beware of balloon rates.

National Marine Lenders Association

The National Marine Lenders Association was formed in 1979 and has many boat loan lenders available on their website.

2019 boat loan rate trends and facts