- U.S. has $1.52 trillion in student debt.

- Tuition can cost over $20,000 a year.

- College students average $29,200 in student debt.

- Student loan debt has been increasing since 2003.

- 25 percent of Americans are in student loan debt.

- Only 423 people receive loan forgiveness.

- Graduates average paying $393 a month towards loans.

- Student loans increased by 116% over a decade.

- The majority of those in debt are between 35-49.

1. Many college students need to go into student loan debt in the U.S due to college expenses. This has caused the nation to reach $1.52 trillion in student debt. This shows that millions of students enter debt to finish college. Due to this, it can cause them serious stress, problems and financial struggles in the future. This is an incredulous amount of money, which demonstrates how expensive the education system has become in the U.S. Many students struggle daily going deeper into debt so that they can finish their degrees to find a decent job.

2. Many colleges have high costs for students, especially those students that come from out of state. Some colleges can become as expensive as $26,290 per year at a university and $35,830 at a private university. While those from the state may get charged less, they likely face thousands of dollars in costs each year. Due to the nature of the world today, many people can’t get a well paying job without a degree, so many students can’t afford these tuition prices. Due to this, they go into student loan debt so that they can cover those costs and hope to pay off the debt in the future. While college stands as the better option in most situations, it costs a lot of money.

3. Some people may think that student loans only affect a portion of college students, but in reality it’s the majority. The average college student will go $29,200 in debt for school. Keep in mind that this represents the average student, meaning that the majority of students are in debt. While some may have more or less debt, the statistics show that most students will leave college with nearly $30,00 in debt.

4. Student debt isn’t something that’s new, but it has been a problem for over a decade. Since 2003, student loan debt has increased each year. This shows that student loans have been a problem for over a decade and continue to show trends of increasing. While inflation exists, the statistics don’t proportionately match to inflation when you consider the growth of minimum wage overtime. This means that schools continue to get more expensive while students don’t have the resources to pay for their college education upfront.

5. Due to the nature of loans, many people who finished school years ago continue to pay debts to this day. This is due to both the size of the debt and the interest rates that accumulate over time. 1-in-4 Americans have student loan debts, meaning that about 44.7 million Americans face student loan related debts. Every day, they face the stress and the struggle knowing that they have to pay off a debt that could equate to more than their starting salary. This becomes a heavy burden and one that makes life challenging and stressful for 25 percent of Americans.

6. While people do face various debts, many people with student loans will apply for student loan forgiveness. This means that people can apply to relieve a portion of their student loans based on certain criteria and requirements. If students meet those requirements, then they can receive loan forgiveness. However, out of the 49,669 people that applied for student loan forgiveness, only 423 applications were approved. Less than 0.8 percent of people who apply will receive approval for their application. Even if people apply, most people have such small odds of the approval that they most likely won’t get it.

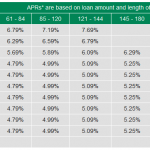

7. While students will face debts due to student loans, some people may feel that those students will pay off their debts sooner than expected. On average, college graduates pay $393 a month towards their student loans. Without considering interest, that would take over 70 months, or five years, to pay off. However, when you consider interest, this increases the amount of time it takes to pay off student loans astronomically. This means that it could take students decades to finally free themselves of student loans. It’s a long, difficult and stressful process to go through, though many may feel that they don’t have a choice.

8. Some people may feel that the increase in student loans isn’t a problem. They may think that it’s only in proportion to the number of people attending college. From 2009 to 2019, student loan debt has increased by 116 percent. This shows that the problem continues to increase and to be a problem for a large portion of Americans. The problem continues to grow and expand, causing more people each day to enter a debt that will take them a long time to pay off.

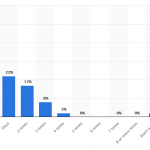

9. People may believe that most of those in student debt are those in school. However, the debt has gone on for so long that those who have graduated and work still make up the largest portion of those in debt. Those in the 35-49 age range hold $548 billion of the student loan debt. This is nearly half of the total. Many people who have been working with their degree for over a decade still have student debts to pay off. This shows how far the debt has gone and how deep of a hole many students are forced to go into to finish college.